kansas sales tax exempt form agriculture

Most large animal small animal and brand applications can be submitted online through Kelly Solutions by clicking here. Payments may be made via credit.

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

For corporations whose business income is solely within state boundaries the tax is 4 of net income.

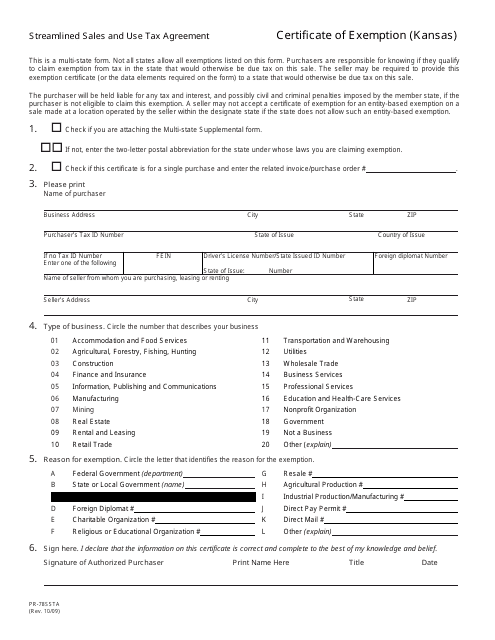

. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. Homeland Security TrainingIS 700. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services purchased.

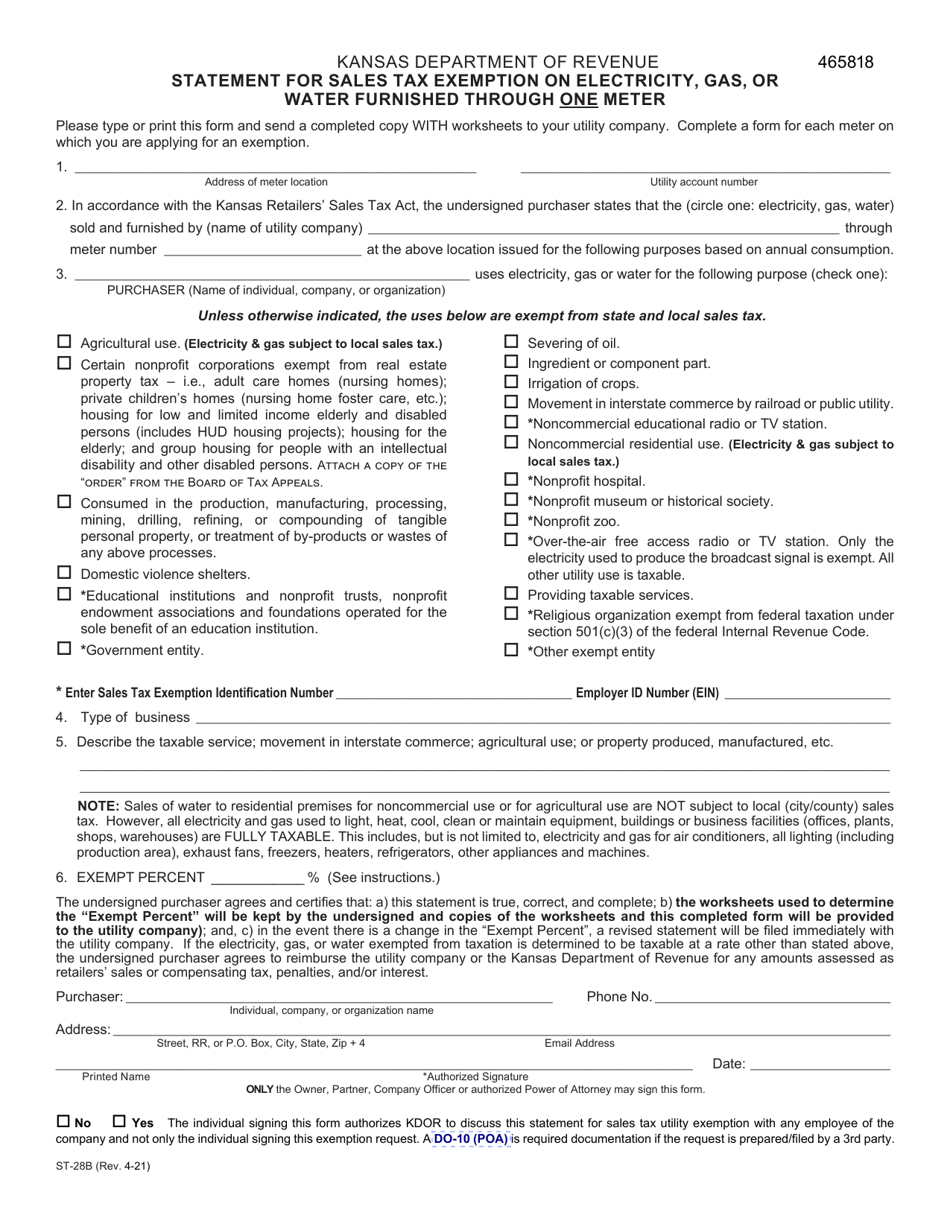

KDA HQ Emergency Evacuation Plan. Ingredient or component part Consumed in production Propane for agricultural use The. Agriculture sales tax exemption.

ARKANSAS COMMERCIAL FARMING MACHINERY EQUIPMENT SALES TAX EXEMPTION CERTIFICATE Form ST-403 Arkansas state code allows for an exemption on. Are exempt from sales tax. One of Oklahoma Farm Bureaus very first policy priorities in 1942 the state sales tax exemption on agricultural inputs is a crucial business tool.

Farmers per se are not exempt from Kansas sales or use tax. These are the tax exemptions for. This page discusses various sales tax exemptions in Kansas.

Dodge City KS 1451 S 2nd. This includes the trees fertilizers pest control chemicals moistureweed barrier and staples and above ground irrigation equipment. Is exempt from Kansas sales and compensating use tax for the following reason check one box.

Is exempt from Kansas sales and compensating use tax for the following reason check one box. Ingredient or component part Consumed in production Propane for agricultural use The. How to use sales tax exemption certificates in Kansas.

In addition net income in excess of 50000 is subject to a 3. Online Applications and Renewals. For tax exemption status.

While the Kansas sales tax of 65 applies to most transactions there are certain items that may be exempt from taxation. Complete the Streamlined Sales Tax Agriculture Exemption Certificate before making your agricultural related purchases with KanEquip. However there are four sales and use tax exemptions specifically for agribusiness.

Form St 28b Download Fillable Pdf Or Fill Online Statement For Sales Tax Exemption On Electricity Gas Or Water Furnished Through One Meter Kansas Templateroller

Archived Press Releases Crawford County Ks

Sales Tax Exemption Fencing Natrual Disasters Wichita Cpa

Fill Free Fillable Kansas Department Of Revenue Pdf Forms

2022 State Tax Reform State Tax Relief Rebate Checks

Form Abc 1013 Fillable Farm Winery Monthly Gallonage Tax Return And Sales Report Rev 07 12

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Kansas Bill Targeting Property Tax Breaks For Wind Farms Fails In Committee Vote Kansas Reflector

The Tax Break For Kansas Farmers That Few Know About Kcur 89 3 Npr In Kansas City

Gov Signs Bill To Allow Fencing Sales Tax Exemption Property Tax Relief

Kansas Income Tax Returns Things To Know Credit Karma

Tangible Personal Property State Tangible Personal Property Taxes

Illinois Sales Tax Exemptions On Farm Equipment

Sales Tax Laws By State Ultimate Guide For Business Owners

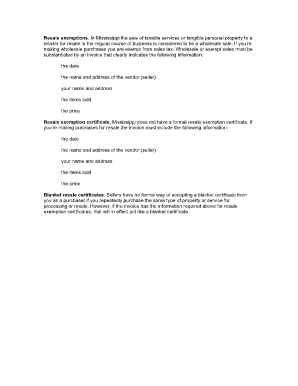

Mississippi Sales Tax Exemption Form Pdf Fill Online Printable Fillable Blank Pdffiller

Pro And Con Tax Provisions In The Build Back Better Act

.jpg)